Gold Price Fintechzoom: Your Ultimate Guide To Understanding And Investing In Gold

Gold has been a reliable store of value for centuries, and its importance in the modern financial landscape continues to grow. With platforms like Fintechzoom providing up-to-date gold price information, investors now have access to real-time data and insights to make informed decisions. Whether you're a seasoned investor or just starting your financial journey, understanding gold prices is essential in building a robust investment portfolio.

Gold prices are influenced by a variety of factors, including global economic trends, geopolitical events, and market demand. As you delve deeper into this article, you'll discover how Fintechzoom can help you stay ahead of the curve by offering comprehensive data and analysis on gold prices. This platform not only provides real-time updates but also helps you interpret the data to make smarter financial decisions.

Our goal is to equip you with the knowledge and tools necessary to navigate the gold market confidently. By the end of this article, you'll have a clearer understanding of how gold prices work, their significance in today's economy, and how Fintechzoom can assist you in maximizing your investment potential.

Table of Contents

- Gold Price Overview

- Factors Affecting Gold Prices

- Fintechzoom Platform

- Real-Time Data and Analytics

- Investment Strategies for Gold

- Historical Trends in Gold Prices

- Gold as a Hedge Against Inflation

- Market Demand and Supply Dynamics

- Global Economic Impact on Gold Prices

- Conclusion

Gold Price Overview

Gold prices have long been a subject of interest for investors and economists alike. The value of gold is determined by a combination of supply, demand, and global economic conditions. Fintechzoom plays a crucial role in providing accurate and up-to-date information on gold prices, making it an invaluable resource for anyone interested in this precious metal.

Through its advanced algorithms and data analytics, Fintechzoom offers insights into how gold prices fluctuate in response to various factors. This platform ensures that users have access to the latest market trends and expert analysis, enabling them to make informed investment decisions.

Why Monitor Gold Prices?

Monitoring gold prices is essential for several reasons:

- Battlebots Champions By Year

- David Dobrik Net Worth 2023

- Ssoyoung Age

- Ksi Net Worth 2024

- Nicolette Gray Dr Phil

- Gold serves as a safe haven during economic uncertainty.

- It acts as a hedge against inflation and currency devaluation.

- Gold prices often reflect broader economic trends, offering valuable insights into market health.

Factors Affecting Gold Prices

Understanding the factors that influence gold prices is critical for investors. Below are some of the key drivers:

Geopolitical Events

Political instability and geopolitical tensions often lead to increased demand for gold as investors seek safer investment options. This heightened demand can drive gold prices upward.

Economic Indicators

Economic indicators such as interest rates, inflation rates, and unemployment figures also play a significant role in shaping gold prices. For instance, lower interest rates tend to increase the attractiveness of gold as an investment.

Fintechzoom Platform

Fintechzoom stands out as a premier platform for tracking gold prices and analyzing market trends. It leverages cutting-edge technology to provide users with real-time data and actionable insights. By integrating machine learning and artificial intelligence, Fintechzoom ensures that its users receive the most accurate and up-to-date information on gold prices.

Features of Fintechzoom

- Real-time gold price updates

- Comprehensive market analysis

- User-friendly interface

- Customizable alerts for price changes

Real-Time Data and Analytics

Access to real-time data is crucial for making timely investment decisions. Fintechzoom excels in this area by offering users instant access to gold price updates. Its analytics tools help users interpret the data, providing a deeper understanding of market dynamics.

Benefits of Real-Time Data

Having access to real-time data offers several advantages:

- Timely decision-making

- Improved risk management

- Enhanced investment opportunities

Investment Strategies for Gold

Investing in gold requires a strategic approach. Whether you're buying physical gold, investing in gold ETFs, or trading gold futures, understanding the market is key to success. Fintechzoom provides the tools and resources needed to develop effective investment strategies.

Types of Gold Investments

- Physical gold: Coins, bars, and jewelry

- Gold ETFs: Exchange-traded funds

- Gold futures: Contracts to buy or sell gold at a future date

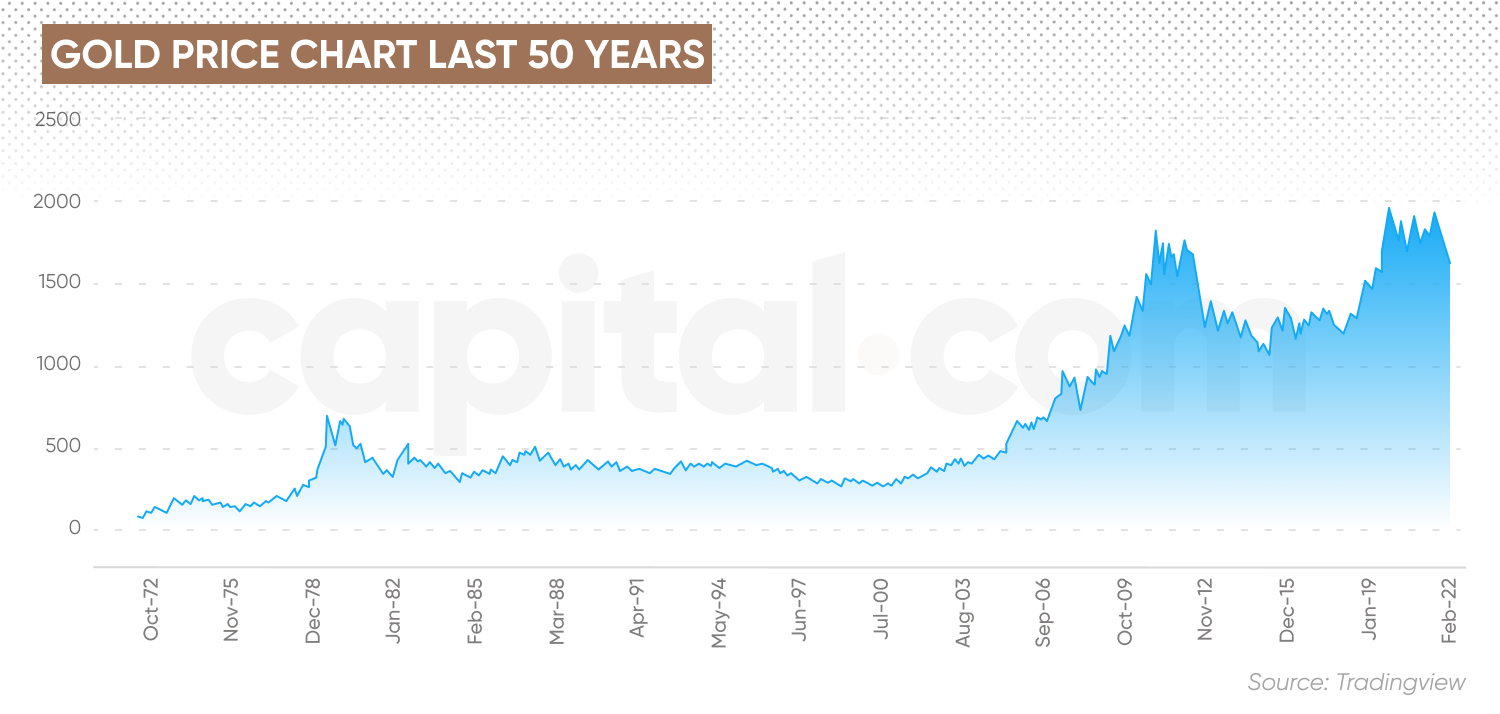

Historical Trends in Gold Prices

Examining historical trends can provide valuable insights into gold price movements. Over the years, gold prices have experienced significant fluctuations due to various economic and political factors. Fintechzoom offers historical data analysis, helping users identify patterns and make informed predictions.

Key Historical Events

- 1971: The end of the Bretton Woods system

- 2008: The global financial crisis

- 2020: The impact of the COVID-19 pandemic

Gold as a Hedge Against Inflation

Gold is widely regarded as an effective hedge against inflation. As the purchasing power of fiat currencies diminishes, the value of gold tends to rise. This makes it an attractive option for investors looking to preserve their wealth over the long term.

How Gold Protects Against Inflation

- Gold maintains its value over time

- It offers stability during periods of high inflation

- Investors can diversify their portfolios with gold

Market Demand and Supply Dynamics

The demand and supply of gold are key drivers of its price. Factors such as jewelry demand, industrial usage, and central bank purchases all contribute to the overall market dynamics. Fintechzoom provides detailed insights into these dynamics, helping users understand the forces at play in the gold market.

Key Players in the Gold Market

- Jewelry manufacturers

- Central banks

- Investors and traders

Global Economic Impact on Gold Prices

Gold prices are closely tied to global economic conditions. Economic growth, trade policies, and currency fluctuations all influence the value of gold. Fintechzoom offers comprehensive analysis of these factors, enabling users to anticipate price movements and adjust their strategies accordingly.

Global Economic Indicators

- GDP growth rates

- Interest rate decisions

- Trade balance figures

Conclusion

In conclusion, understanding gold prices and their underlying factors is crucial for anyone looking to invest in this precious metal. Platforms like Fintechzoom provide invaluable resources for tracking gold prices and analyzing market trends. By leveraging the tools and insights offered by Fintechzoom, investors can make informed decisions and maximize their returns.

We encourage you to explore Fintechzoom further and take advantage of the wealth of information it provides. Don't hesitate to leave a comment or share this article with others who may benefit from it. For more insights into the world of finance and investment, be sure to check out our other articles.

Gold Price Fintechzoom Live Gold Charts, News, and Analysis

Gold Price Fintechzoom RealTime Gold Price Updates

Gold Price Fintechzoom RealTime Gold Price Updates